Alright, let's get one thing straight right off the bat: I was wrong about AppLovin (APP). Dead wrong. Remember those bearish takes I was peddling? Yeah, those didn't exactly age like fine wine, did they? More like milk left out in the sun.

The Numbers Don't Lie (Even if I Wish They Did)

Sixty-eight percent revenue surge year-over-year? Free cash flow nearly doubling? Give me a break. It's like they're printing money over there. And then they go and authorize another $3.2 billion in share repurchases? Seriously? That's not just confidence; that's straight-up arrogance. It's like they're saying, "Yeah, we know what we're doing, and we're gonna shove it in your face."

And the stock price? Up almost 2% to $628.65 as of November 6, 2025? That's after the freakin' earnings pop! I mean, seriously, what is going on here?

I’ve spent a decade at a Big 4 audit firm, so I'm not exactly a newbie when it comes to dissecting financials. I pride myself on thorough research, a long-term perspective... and apparently, the ability to completely whiff on a stock analysis.

What the Hell Happened?

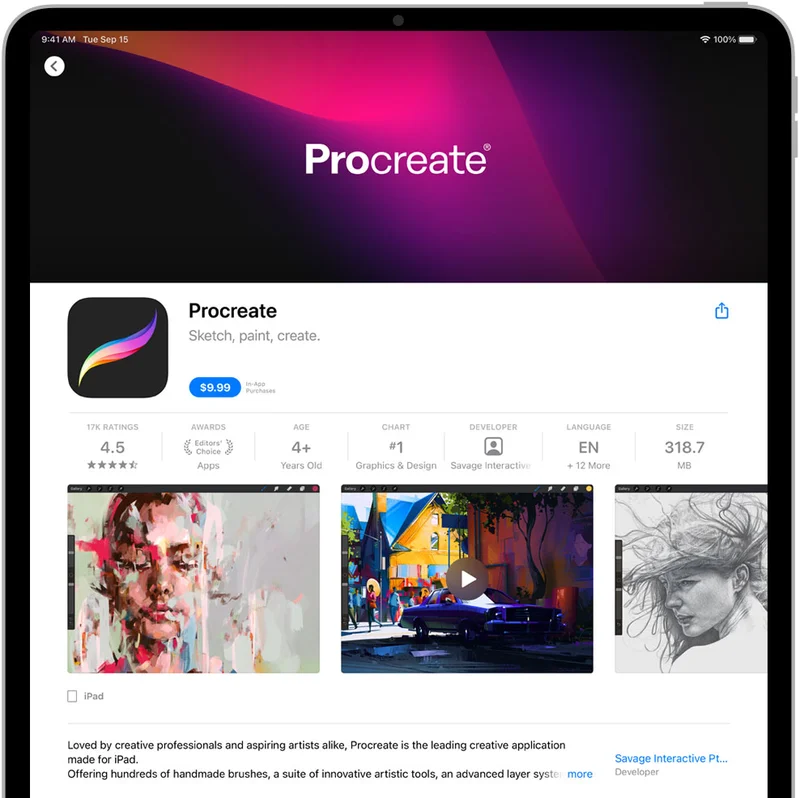

I'm still trying to figure out where I went wrong. Was it a fundamental misjudgment of the market? Was I too focused on the potential downsides and not enough on the upside? Or, hear me out, was it just plain bad luck? Offcourse, I'd like to think my analysis is better than something you'd find on Cash App stock forums, but maybe I'm giving myself too much credit.

Maybe I should have seen this coming. After all, app stock price moves can be pretty damn unpredictable, especially in this market. And AppLovin, with its focus on mobile gaming and app monetization, is definitely riding some powerful trends. Still... a 68% revenue jump? That's not just "riding a trend"; that's strapping a rocket to your backside.

It's easy to say, in hindsight, that the signs were there. But let's be real, who actually predicted this kind of growth? Show of hands? Yeah, didn't think so. As one Seeking Alpha analysis puts it, AppLovin: Q3 Earnings Made Me Look Bad (Rating Upgrade) - Seeking Alpha.

I'm not saying the whole market is irrational – but it's times like these when you start to wonder if you're the only sane person left in the asylum.

So, What Now?

So, what do I do now? Do I double down on my bearish stance and risk looking even more foolish? Do I admit defeat and jump on the bandwagon, hoping to catch a ride to the moon? Or do I just quietly slink away and pretend this never happened?

Honestly, none of those options sound particularly appealing. Maybe I'll just stick to analyzing safer bets, like, I don't know, bonds. Yeah, bonds. Safe, boring, predictable bonds. That's the ticket. No more trying to predict the future of tech. No more trying to outsmart the market. Just good old-fashioned, low-risk, low-reward bonds.

Wait a minute... are bonds even safe anymore? With inflation and interest rates and... never mind.

Time to Eat Crow... Again

标签: #app stock