Generated Title: Marvell Stock: AI Savior or Just Another Overhyped Chip Play?

Alright, let's get one thing straight: I'm so freakin' tired of hearing about AI this, AI that. Every company now slaps "AI" on their name and suddenly they're worth billions. Marvell Technology? Same story, different day.

The Amazon Hype Train

So, Amazon's Trainium processor biz is supposedly booming, and Marvell's riding shotgun. Okay, fine. Jassy's yapping about it being a "multibillion-dollar business" with 150% quarter-over-quarter growth. Color me skeptical. We all know how these earnings calls go. It's all sunshine and rainbows until the next quarterly report drops.

And this Project Rainier supercomputer thing? Half a million Trainium2 chips, gonna be over a million by year-end... Sounds impressive, right? But what's the actual output? What real-world problems are they solving, or is it just more vaporware designed to pump the stock price? I mean, gimme a break.

J.P. Morgan's Harlan Sur is all bullish, slapping a $120 price target on MRVL. Analysts, man. They're always "overweighting" something. It's their job to generate buzz, not provide actual insight. What are they even basing this on?

Digging Deeper (or Not)

Marvell's CEO, Matt Murphy, is out there spinning tales of AI dominance, data center revenue skyrocketing, electro-optics business going from $600 million to $3 billion... It's the classic "hockey stick" projection that never seems to materialize.

Then there's this "over 20 multigenerational custom design wins" claim, worth $75 billion in lifetime revenue. Lifetime? That's like saying I'm gonna make a million dollars by selling lemonade when I'm 80. It's so far out it's basically meaningless.

Oh, and their operating margins are up, EPS is up, the whole nine yards. Fantastic. But what about the actual products? Are they any good? Are they truly innovative, or are they just riding the AI wave like everyone else? Details are suspiciously scarce, offcourse.

And SoftBank considered buying them earlier this year? LOL. Another pump and dump scheme that thankfully didn't pan out, it seems.

The Reality Check

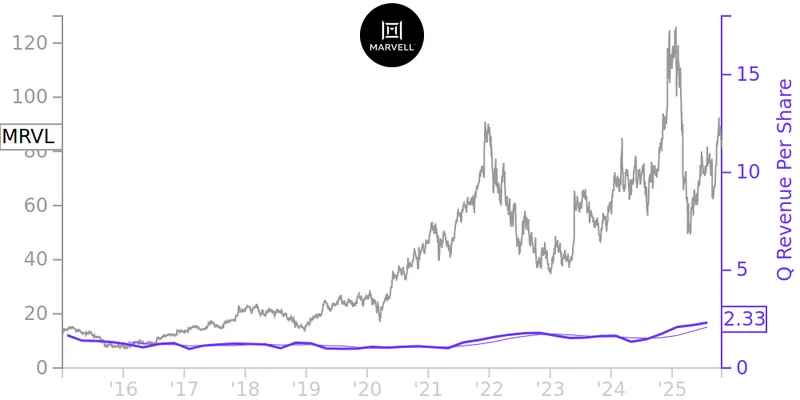

Here's the kicker: MRVL stock is down 17% YTD. So much for being an "AI powerhouse." The market ain't buying the hype, at least not yet. Marvell Technology (MRVL) Sees a More Significant Dip Than Broader Market: Some Facts to Know

Analysts are forecasting revenue to explode to $16 billion by fiscal 2030. That's a long freakin' time in the tech world. A lot can happen between now and then. Remember Pets.com? Exactly.

They're trading at a higher-than-average forward earnings multiple. So, basically, they're overpriced based on potential growth, not actual performance. Sounds like a bubble to me.

Then again, maybe I'm the crazy one here. Maybe Marvell really is the next big thing. But let's be real, in this market, anything is possible.

So, What's the Real Story?

It's all smoke and mirrors, baby. Marvell's another company trying to cash in on the AI craze. Are they fundamentally sound? Maybe. Are they worth the hype? Absolutely not. Don't fall for it.

标签: #mrvl stock