Bitcoin's been playing possum again, hasn't it? After a stomach-churning drop, we're seeing the price nudge upwards, sparking the usual chorus of "Is this the bottom?" and "To the moon!" chants. But before you max out your credit cards on crypto, let's inject a little data-driven sobriety into the conversation. The question isn’t whether Bitcoin can bounce, but whether this bounce has any legs.

The headlines are screaming "recovery," pointing to Bitcoin's recent climb back above $90,000 after briefly flirting with the $80,000 zone. Sentiment is shifting, but let's be honest, sentiment in crypto is about as reliable as a politician's promise. We need to dig deeper.

Technicals vs. Fundamentals: A Looming Disconnect[/H2]

Technically, sure, there are signs of life. The daily chart shows BTC trying to reclaim the $89,000-$93,000 range. The four-hour chart even hints at breaking above a bearish trendline. Optimists are eyeing the $103,000 supply zone. But here's the problem: these technical indicators are like reading tea leaves if the underlying fundamentals aren't there.

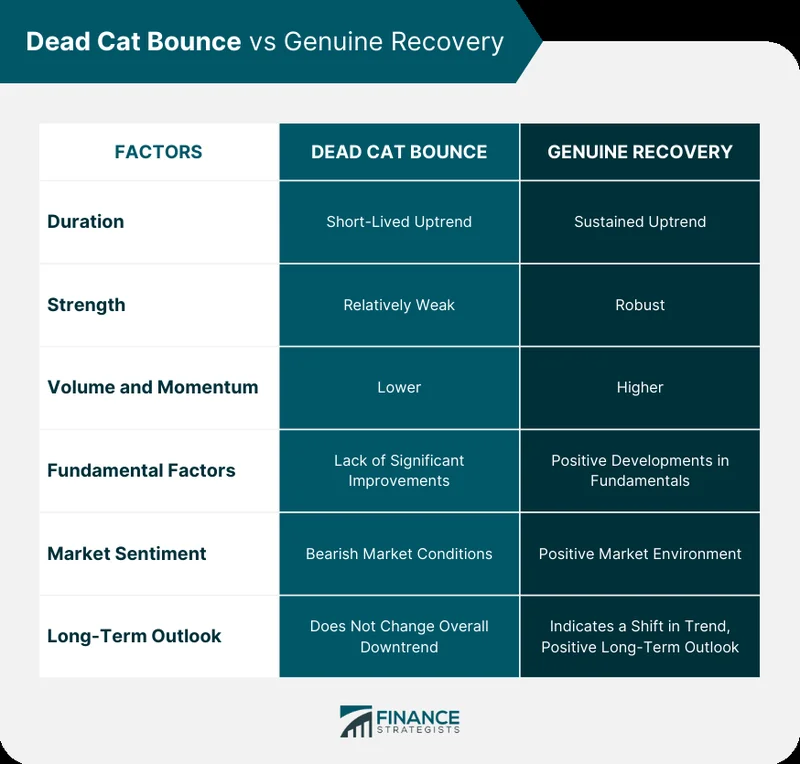

One analyst, Elja, flags $98,000 as a critical level. Fail to close above it, and the bearish trend likely continues. Another, Ted Pillows, calls this an uptick a mere "relief bounce," not a true shift in sentiment. These guys are right to be cautious. Bitcoin Relief Rally Sparks Caution as Analysts Warn of Dead Cat Bounce

The on-chain data offers a slightly more compelling narrative. Exchange reserves are down, supposedly signaling a move to cold storage and long-term holding. The theory is that "smart money" is accumulating. Historically, this has been a bullish sign. But let's not get carried away. A drop in exchange reserves could mean accumulation. Or, it could mean people are moving their Bitcoin to DeFi platforms for yield farming—a completely different risk profile. We need more data.

The problem with relying solely on exchange reserve data is that it paints a picture of scarcity without fully accounting for the movement of assets within the broader crypto ecosystem. Are these coins genuinely being locked away, or are they simply being shuffled around to chase the next fleeting trend?

The $50K Elephant in the Room[/H2]

Then there's the bearish counter-narrative. Remember that "inevitable" crash to $50,000 that some analysts were predicting? That's still lurking in the background. Bitcoin finished November down nearly 18%, its worst performance since the 2018 bear market. Ouch.

I've looked at hundreds of these market analyses, and one thing always sticks out: the human tendency to cherry-pick data that confirms pre-existing biases. Bulls will point to the exchange reserve data; bears will highlight the monthly losses. The truth, as always, is somewhere in between.

The Kobeissi Letter pointed to systemic market weakness and thin liquidity as reasons for sudden price drops (a $4,000 drop in minutes, they noted). Arthur Hayes, ex-BitMEX CEO, blamed the Bank of Japan and potential rate hikes. Everyone has a theory, and most of them are self-serving.

Here's what I find genuinely puzzling: the disconnect between the supposed institutional adoption of Bitcoin and its continued volatility. If big players are truly in the game for the long haul, why are we still seeing these wild price swings? It suggests that either the "institutional adoption" narrative is overblown, or that these institutions are trading Bitcoin with the same short-term, speculative mindset as everyone else.

And here's a personal aside: I'm starting to think that the entire concept of "institutional adoption" is a bit of a red herring. It's a convenient story that helps justify high prices, but it doesn't really change the underlying dynamics of the market. Bitcoin is still driven by sentiment, speculation, and the ever-present fear of missing out.

One data point I found interesting was the Coinbase premium, which reflects U.S. demand. It briefly flipped positive, but as Against Wall Street noted, these signals take time to play out. It's about trend and momentum, not a single day's trading.

What I am asking is this: How was the Coinbase premium data gathered and calculated? Are we sure it accurately reflects overall U.S. demand, or is it simply a reflection of trading activity on a single exchange? These are the types of methodological questions that get glossed over in most analyses.

Finally, let's talk about stablecoins. Binance's ratio of stablecoins to BTC reserves is at a six-year high, suggesting plenty of "dry powder" waiting to be deployed. The implication is that a market turnaround is inevitable. But here's the catch: that dry powder could also be deployed into other crypto assets, not just Bitcoin. Or, it could simply sit on the sidelines, waiting for a clearer signal.

This Bounce Is Built on Shaky Ground[/H2]

Bitcoin's recent price action reminds me of a poorly constructed building. It might look impressive from the outside, but a closer inspection reveals cracks in the foundation. The technical indicators are mixed, the on-chain data is open to interpretation, and the broader market sentiment remains fragile. Until we see a sustained break above those key resistance levels—and a clear shift in the underlying fundamentals—I'm treating this "recovery" with extreme caution. The data just isn't there to support a full-blown bullish resurgence.