Today is not a normal Friday.

Usually, by the end of the week, the market has digested the bulk of its significant economic inputs. But today, the collective hum of trading floors will fall silent at 1:30 PM BST, all eyes fixed on a single data release. The U.S. Consumer Price Index (CPI) for September is finally being published, delayed by a government shutdown now entering its fourth week. This isn't just another data point; it's a piece of critical intelligence released into an information vacuum, and the market is starved for it.

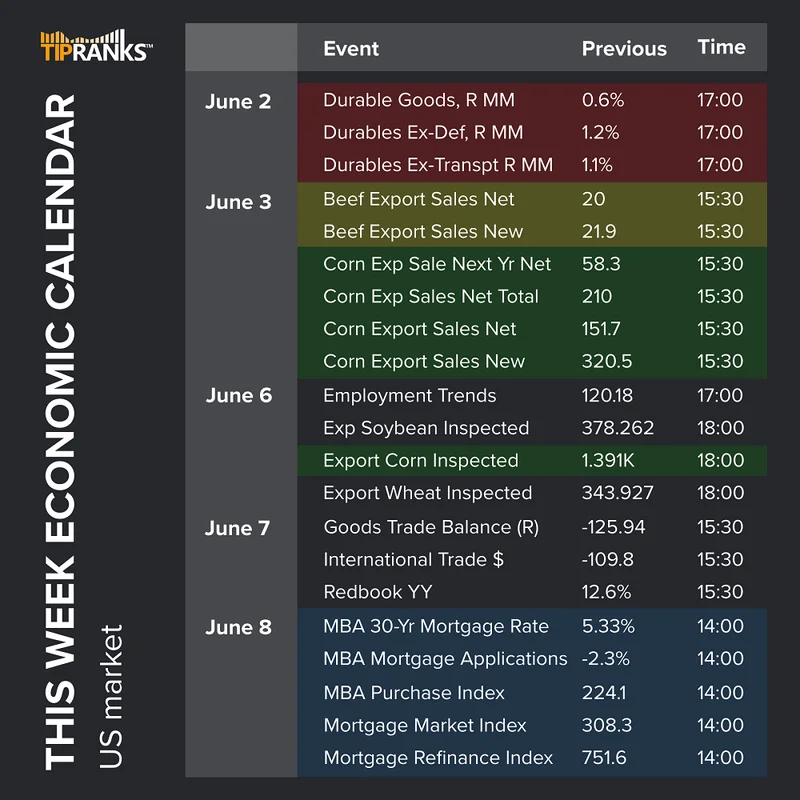

The Bureau of Labor Statistics (BLS), despite being mostly shuttered along with other federal agencies, made the unusual decision to release this specific report. That alone tells you everything you need to know about its perceived importance. With a Federal Reserve interest rate decision looming next week, this single print on inflation has become the focal point of global market anxiety. Everything else on the Economic calendar: Delayed US CPI report due Today 📌—a flood of preliminary PMI reports from Europe, speeches from central bankers—risks becoming background noise. The stage has been set for a single number to dictate the narrative.

The Illusion of a Single Answer

The market’s obsession with this delayed CPI report is perfectly understandable, but it’s also a symptom of a deeper dysfunction. When you deprive a system of its regular flow of information, it latches onto the first significant signal it receives with disproportionate force. It’s like a dehydrated man in a desert focusing solely on a single drop of water on the horizon, ignoring the broader landscape. That drop is the September CPI, and the market is about to drink it down without considering its context.

Let’s look at the consensus forecasts. The headline CPI is expected to come in at 3.1% year-over-year, a slight uptick from the previous 2.9%. The month-over-month figure is forecast to hold steady at 0.4%. But the real story, as always, is in the core reading, which strips out volatile food and energy prices. Core CPI is projected to be 3.1% year-over-year, exactly the same as the prior reading. No improvement. No backsliding. Just a stubborn, persistent level of inflation that remains well above the Fed's target. A 0.3% month-over-month core increase annualizes to over 3.6%—to be more exact, 3.65%—a rate that offers zero comfort to policymakers.

While Wall Street holds its breath for this lagging indicator from September, a deluge of more current data for October is being released almost simultaneously. We're getting preliminary PMI readings from France, Germany, the Eurozone, the UK, and the U.S. itself. These are forward-looking surveys of purchasing managers, providing a real-time pulse on manufacturing and services activity. The German manufacturing PMI, for instance, is forecast to remain flat at a contractionary 49.5. The S&P Global Services PMI for the U.S. is expected to dip slightly from 54.2 to 53.5. These numbers paint a complex, mixed picture of a global economy that is slowing, yet still battling inflation. But will anyone even notice them? Or will the market’s entire reaction function be governed by a single, month-old inflation print?

The Fed's Blind Spot

This entire situation puts the Federal Reserve in an incredibly difficult position. The decision to release the CPI data was made precisely because the Fed needs it for next week's meeting. But relying so heavily on one delayed report, when the rest of the government's data-gathering apparatus has been offline, is a precarious way to set monetary policy for the world's largest economy. We are missing the full context. The jobs report, which normally provides the other half of the Fed's dual mandate puzzle, is also delayed. How can you accurately interpret an inflation number without its corresponding labor market data?

I've looked at hundreds of these pre-release consensus sheets, and the tightness of these CPI forecasts is unusual. It suggests a market that has priced in a very specific, narrow outcome, creating an asymmetric risk profile. If the numbers come in exactly as expected (a scenario with high probability), the market might breathe a sigh of relief, but the underlying problem of sticky inflation hasn't been solved. If, however, there's even a minor deviation—say, core CPI prints at 0.4% MoM instead of 0.3%—the reaction could be violent. The information vacuum amplifies the impact of any surprise.

This brings me to a methodological critique. We are told the BLS is releasing the data, but we have limited transparency into the process under shutdown conditions. Are they operating with a skeleton crew? Has the data collection and adjustment process been affected in any way? The integrity of the number is assumed to be perfect, but the circumstances are anything but normal. The market is treating this report as gospel (it has a reported precision down to a single decimal place), yet it's being produced under duress. What is the margin of error on a report compiled during a government shutdown? That’s a question no one is asking, but everyone should be.

Ultimately, the number itself might be less important than the market’s interpretation of the Fed’s interpretation of the number. It’s a chain of speculation built on a fragile foundation. The Fed is being forced to make a critical decision with incomplete, delayed, and potentially compromised data. And we're all just along for the ride.

This Isn't Analysis; It's a Coin Flip

Let's be perfectly clear. The market's behavior today isn't about sophisticated analysis or fundamental valuation. It's a high-stakes guessing game centered on a single data point. The hyper-focus on the September CPI is a dangerous distraction from the broader, more nuanced economic reality being painted by the timelier PMI data. We are prioritizing the drama of a single, delayed number over the complex mosaic of the present. This isn't investing; it's gambling on a government calculation, and the house is operating with a blindfold on.

标签: #economic calendar