Beyond the Balance Sheet: Palantir's Numbers Are a Window Into a New Reality

We’re just days away from Palantir’s next earnings call on November 3, and the usual chatter is filling the airwaves. Wall Street is looking at an earnings-per-share estimate of $0.17, a staggering 70% jump from last year. They’re projecting revenues of $1.09 billion, a more than 50% surge. These aren't just good numbers; they’re the kind of figures that should be causing a tectonic shift in how we view the company. Yet, beneath the surface of these explosive metrics, there’s a whisper of doubt.

Some models, like the Zacks Earnings ESP, are flashing a negative signal, suggesting a potential miss. Analysts have grown a bit more bearish recently, nudging the company into a "Hold" category. It’s a classic Wall Street story: incredible, world-changing growth on one side, and cautious, backward-looking statistical models on the other.

And I have to say, this is the kind of disconnect that reminds me why I left pure research and started writing. When I first saw that 70% year-over-year earnings growth projection, I honestly just sat back in my chair, speechless. Because what we're witnessing isn't just another tech company hitting its quarterly targets. We are watching the financial footprint of a new operating system for society being laid down in real-time. To get bogged down in whether they beat the estimate by a penny or miss it by a hair is to miss the forest for a single, uninteresting leaf.

The problem is that our traditional financial models are like trying to measure the speed of light with a stopwatch. They are tools built for a linear, predictable world. But Palantir doesn’t operate in that world. It’s a company built on exponential curves. How do you model the long-term value of a platform that can prevent a billion-dollar supply chain from collapsing? What’s the quarterly ROI on averting a manufacturing disaster or accelerating a life-saving drug trial? These aren’t line items; they’re paradigm shifts.

The Operating System for Reality

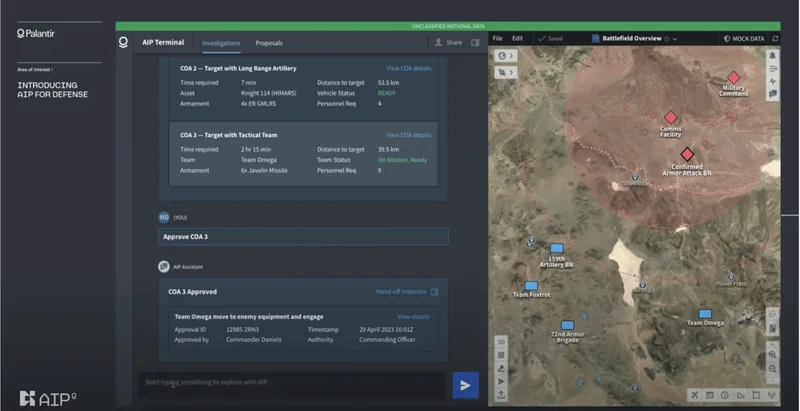

Let's get to the heart of what’s happening here. People hear "Palantir" and think of complex government contracts or shadowy data analysis. But that’s an outdated picture. The real revolution is in their concept of "ontology." Now, that sounds like a dense, academic term, so let's break it down. In simpler terms, it’s about creating a perfect, dynamic digital twin of an entire organization—its factories, its supply lines, its people, its finances—and making it all talk to each other. It’s not a dashboard; it’s a living, breathing model of reality itself.

This is the "Big Idea" that I believe most of the market is still struggling to grasp. We’re not talking about software as a tool anymore. This is software as an environment. It’s the foundational layer upon which future decisions will be made.

My favorite analogy for this is the invention of the standardized shipping container. Before the 1950s, global trade was an absolute nightmare of mismatched crates, barrels, and sacks. Every port, every ship, every truck was a bespoke, inefficient puzzle. Then, the simple, standardized steel box arrived, and overnight, the entire planet’s logistical network snapped into a coherent, scalable grid. It wasn’t just a better crate; it was a new language for global commerce that unlocked decades of prosperity. That is what Palantir is building for data. It’s creating the standardized container for institutional knowledge, allowing any organization to finally see itself as a whole, integrated system.

This is the engine driving that 50% revenue growth. It’s the quiet, relentless integration of this new operating system into the bedrock of our economy. You can see the excitement for this not just in the numbers, but in the developer communities and on forums like Reddit, where the discussion isn't about stock price, or questions like Palantir Technologies Inc. (PLTR) Earnings Expected to Grow: Should You Buy?, but about what new problems can be solved. That’s the real leading indicator of a revolution.

Of course, with this kind of power comes immense responsibility. When you’re building the nervous system for industry and government, the ethical guardrails are not just important; they are everything. Who gets to set the rules for this new reality? How do we ensure transparency and prevent the misuse of such a comprehensive view of the world? These are the questions we should be asking, far more profound than any short-term earnings prediction.

The Signal Is the Growth, Not the Prediction

So, when the numbers come out on November 3, you’ll see the headlines focus on the "beat" or the "miss." It’s the easiest story to tell. But I urge you to look past it. Look at the year-over-year growth. Look at the trajectory. The fact that a company of this scale can accelerate its revenue by over 50% is the real signal—it's the sound of a new foundation being poured, of a fundamental rewiring of how our institutions think and operate, and it’s happening so fast that the gap between what is and what will be is closing faster than we can even model.

Palantir has a history of surprising the market, beating estimates three of the last four times. But even if the negative ESP proves right and they fall short by a fraction, does it change the trajectory? Does a rocket ship veering a single degree off its initial predicted course mean it won’t reach the moon? Of course not. It just means our old maps weren’t drawn for this kind of journey.

The most accurate prediction models are built on historical data. They are, by their very nature, backward-looking. They’re great for predicting the path of a car on a known road. But they are utterly useless for charting the course of something that is building the road as it goes. What does the future look like when every hospital can instantly model patient outcomes, or every utility can predict grid failures before they happen? What new industries become possible when the friction of data is finally, truly removed?

The Future Isn't Being Predicted; It's Being Built

Let Wall Street obsess over its decimal points and its surprise predictions. Those are artifacts of an old way of thinking. The real story, the one that will be written in the history books, isn't about a quarterly report. It’s about the staggering, almost unbelievable growth that points to a fundamental shift in our world. While analysts are busy predicting, Palantir is busy building. And in the long run, that is the only metric that will ever truly matter.

标签: #palantir stock