Title Fulfillment:

[Generated Title]: Privacy Coins: A Flash in the Pan, or the Future of Finance?

Privacy coins: a flash in the pan, or the future of finance? That's the question on everyone's lips after the recent surge. The numbers tell a story, but as always, it’s a story that needs careful parsing.

The Privacy Coin Pump: A Statistical Overview

The market capitalization of privacy-focused cryptocurrencies jumped nearly 80% by early November 2025, briefly exceeding $24 billion—to be more exact, $24.9 billion. Privacy coins surge 80%: Why Zcash and Dash are back in the spotlight - TradingView Zcash (ZEC) saw a seven-year high, nearing $449, with triple-digit monthly gains. Dash (DASH) also hit a three-year peak. The headlines screamed "privacy is back," fueled by chatter and bold calls. But let's dig deeper.

What drove this? Some traders cited increased scrutiny on compliance-heavy on-ramps and blockchain analytics as a reason to rotate into privacy assets. Which, on the surface, makes sense. As governments and regulators tighten their grip (the impending EU restrictions on "anonymity-enhancing" coins across regulated platforms by 2027 are a prime example), the appeal of coins designed to obscure transaction details understandably rises.

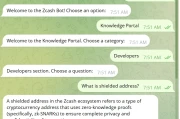

Zcash, with its zero-knowledge proofs (originally zk-SNARKs, now Halo 2) allowing for both transparent and shielded transfers, and Dash, featuring CoinJoin for non-custodial mixing, offer varying degrees of privacy. Zcash's Network Upgrade 5 (NU5) even eliminated the "trusted setup" ceremony, streamlining private payments.

But here’s the rub: privacy on Zcash is opt-in. Users have to choose shielded addresses. Dash's CoinJoin, while a solid feature, isn't exactly seamless for the average user. So, are these coins really providing the level of anonymity that's driving this surge, or is something else at play? The question is, how many users are actually using the privacy features? Without concrete data on shielded vs. transparent Zcash transactions, and CoinJoin usage on Dash, it's hard to definitively attribute the price increase solely to a desire for privacy.

Regulatory Headwinds and the Long Game

The elephant in the room is regulation. Privacy-enhancing assets are squarely in the crosshairs of Anti-Money Laundering (AML) regulations, including the FATF Travel Rule and EU restrictions. The EU's phased-in restrictions on "anonymity-enhancing" coins across regulated platforms through 2027 are a significant hurdle.

And this is the part of the report that I find genuinely puzzling: how can a sector facing such intense regulatory pressure experience such a dramatic surge? Are investors betting that these coins will somehow navigate the regulatory landscape unscathed? Or are they simply ignoring the risks, driven by short-term speculation?

Zcash's upcoming halving is being touted as a potential growth catalyst. Halvings, historically, have been bullish for Bitcoin (BTC). But equating Zcash's halving to Bitcoin's is like comparing apples to oranges. Bitcoin's scarcity is hard-coded and universally understood. Zcash's value proposition is far more nuanced, intertwined with the ever-shifting regulatory landscape and the actual adoption of its privacy features.

It's worth asking: is the market overestimating the impact of the halving, while underestimating the regulatory risks?

Methodological Critique: The available data focuses on price movements and anecdotal reasons for the surge. What's missing is granular data on actual usage of privacy features. How many Zcash transactions are shielded? How many Dash users are actively using CoinJoin? Without these numbers, we're essentially flying blind.

A Classic Pump and Dump?

The recent surge looks suspiciously like a classic pump and dump, fueled by hype and a narrative that doesn't quite hold up under scrutiny. Until we see concrete evidence of widespread adoption of privacy features and a clearer regulatory path, it's hard to view this as anything more than a flash in the pan.

So, What's the Real Story?

The numbers suggest a short-term speculative bubble, not a fundamental shift towards privacy-focused finance.

标签: #Zcash